- The annual ranking published by Insure Our Future places Mapfre below all other European insurers in terms of climate commitments, with the exception of Lloyd’s.

- The leading Spanish insurer, which has a strong presence in Latin America, needs to phase out its support for oil and gas projects.

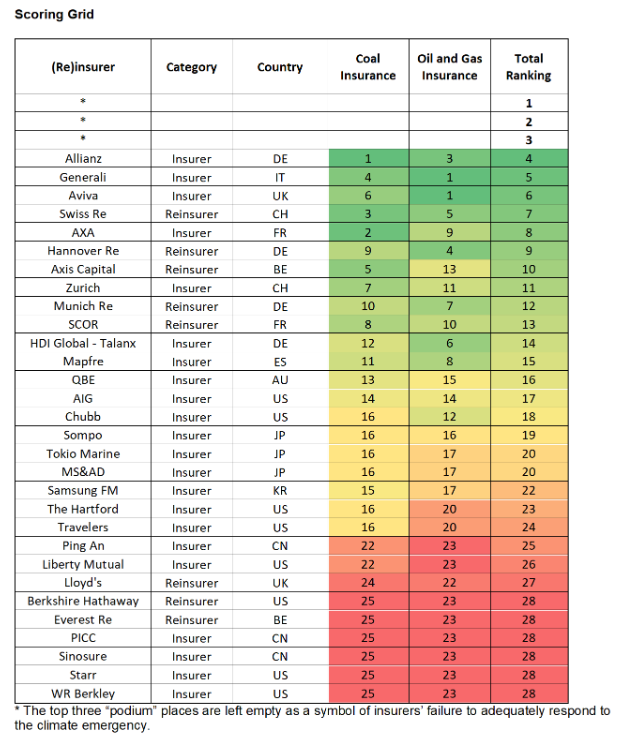

Each year, Insure Our Future (IoF), a global coalition of organisations that aims to pressure insurers to intensify their efforts in the face of the climate crisis and of which the International Institute for Law and the Environment (IIDMA) is a member, assesses and ranks 30 leading insurance (and reinsurance) companies on the effectiveness of their fossil fuel policies.

The scores are based on insurers’ responses to IoF surveys and publicly available information. In the 2023 ranking, Mapfre, Spain’s leading insurer, ranks fifteenth globally in terms of its fossil fuel underwriting restrictions. It should be noted that in this year’s ranking the first three positions are left empty, in order to exemplify the Insurance Industry’s failure to bring an end to the climate crisis fifty years after becoming aware of the impact of climate change.

Although Mapfre has adopted some restrictions on fossil fuels, especially with regards to coal, it must step up efforts to phase out its significant support for oil and gas projects in Latin America. Overall, Mapfre lags behind all other European insurers except Lloyd’s, and has failed to meet its pledge to adopt targets to reduce absolute insured emissions by 34% by 2030.

Internationally, the growing frequency and severity of floods, hurricanes, wildfires, droughts and other climate-related disasters has seen insurance payouts for natural catastrophes soar to an average $110 billion a year since 2017, more than twice the average over the previous five years. Nevertheless, the report reveals that most insurers continue to support projects to increase oil and gas production, despite the fact that the world’s leading climate scientists, from both the Intergovernmental Panel on Climate Change and the International Energy Agency, agree that this is incompatible with the goal of limiting global temperatures to 1.5°C as set out in the Paris Agreement.

Insurers have introduced restrictions on coal that are having a real impact: new coal-fired power plants have become virtually ‘uninsurable’. This means that now, although developments have slowed, coal companies are finding it increasingly difficult to get insurance for new projects and existing operations. This demonstrates the power of the insurance industry to accelerate the transition away from fossil fuels. Insuramore calculates that insurance companies with a 41.2% share of the commercial property and casualty market and a 62.7% share of the reinsurance market have now taken action, up from 39.8% and 58.2% respectively in 2022. However, the move away from fossil fuels does not respond to the urgency of the climate crisis, and most insurers continue to underwrite the expansion of oil and gas infrastructure.

Major insurers have also abandoned the climate change commitments they made as members of the Net Zero Insurance Alliance, launched on the eve of COP26 in Glasgow. Members committed to reduce emissions from the companies they insure by 34% from 2019-2030 and pledged to publish a transition plan by June 2023 and net zero targets by the end of July. However, by September 2023, 20 of the 31 members had left the alliance under threat of antitrust action in the US by the fossil fuel lobby. The outgoing members promised to keep their climate commitments but have not done so at all. No insurer has set targets to reduce its absolute insured emissions by at least 34% by 2030, and only a few have published transition plans and net zero targets.

“If insurance companies took climate science seriously, they would fully align their underwriting and investment strategies with a credible 1.5°C pathway and end all support for increased fossil fuel production. They would be suing fossil fuel companies, to make polluters pay for the growing costs of climate disasters and keep insurance affordable for climate-affected communities”, concludes Peter Bosshard, Global Coordinator of the Insure Our Future campaign.